Soaring Rents in the Southwest Go Underrepresented in Inflation

Last month we showed that U.S. inflation may be underestimated due to the use of a measure called owners’ equivalent rent, which makes up 30% of the core consumer price index. When the CoreLogic single-family rent index is used as an alternative measure for price changes in owner-occupied housing, we saw core inflation increasing by one-to-two percentage points faster than what was reported from April to July of 2021.

The CoreLogic single-family rent index is also available for more than 100 metro areas, which can be used to compute metro-level inflation measures. Let’s look at two metro areas from the Southwest U.S. that illustrate how inflation appears to be underestimated and delayed in the core CPI.

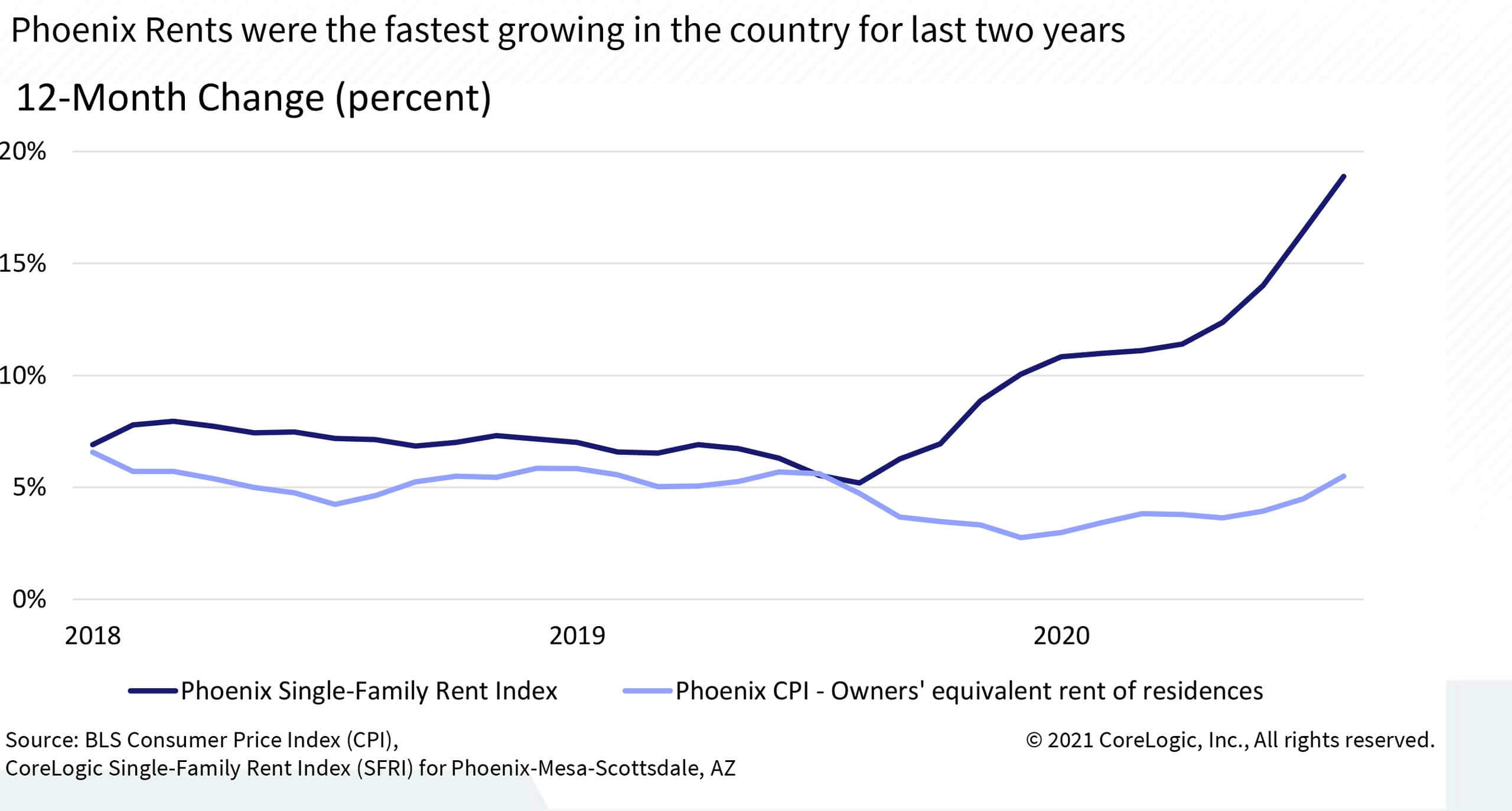

Population growth in Phoenix, Arizona has been amongst the highest in the country, leading to rent increases.

Figure 1: Phoenix SFRI Increasing Three Times Faster Than OER

Rents in Phoenix have been growing the fastest of the metro areas covered by the CoreLogic single-family rent index for the past two years. Phoenix single-family rents increased 19% in July 2021, more than double the national rate. However, the owners’ equivalent rent measure used in the core CPI grew by just 5%.

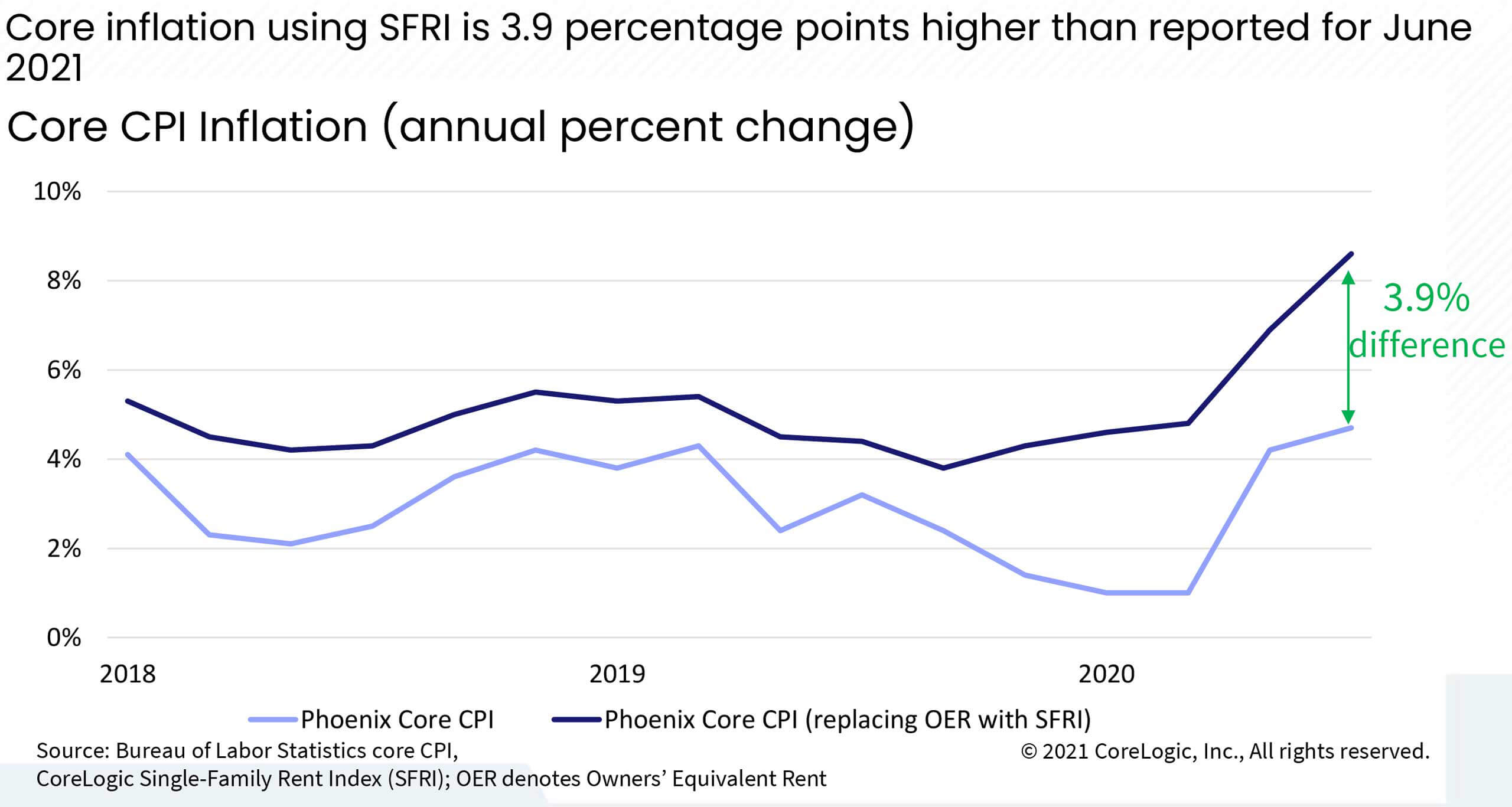

Figure 2: Phoenix Inflation Nearly Two Times Higher Using SFRI

When the single-family rent index is used to measure rent equivalence for owner-occupied homes, core inflation runs two-to-three percentage points faster than reported for the past 10 months.

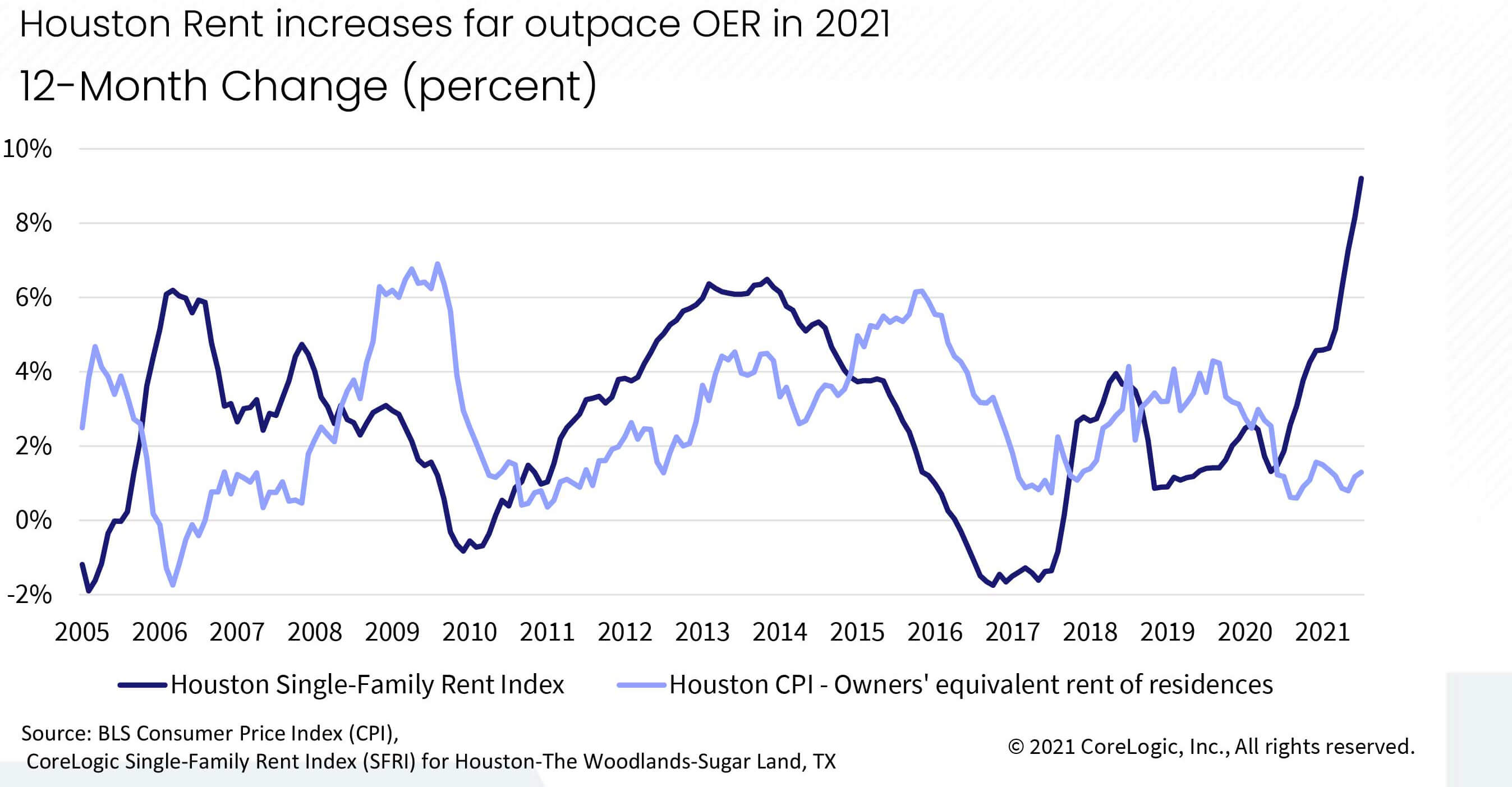

Figure 3: Houston SFRI Turns Sooner than OER

In the case of Houston, Texas the CoreLogic single-family rent index increased 9% for July, compared with 1% for the owners’ equivalent rent. These measures can be compared for a longer time period in Houston, and we can see that not only is single-family rent growth more variable than the owners’ equivalent rent, but it also experiences turning points sooner.

Inflation pressures have been a top concern for many consumers and policymakers for much of the last year. However, official measures showed that inflation was largely under control for all of 2020 and the early part of 2021. These measures didn’t capture soaring single-family rents that much of the country experienced, and therefore underestimated the level of inflation that was emerging in late-2020. This level of underestimation is even higher in some metros than it is in the U.S. overall.